Wells Fargo Deposit

Wells Fargo Bonus Promotions

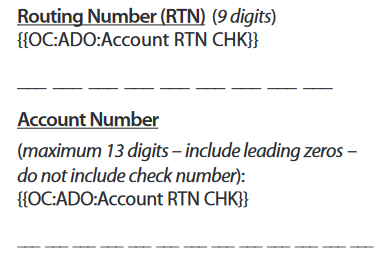

- The Wells Fargo direct deposit form serves as a method of gaining the most basic information to set up the electronic funds transfer necessary for Direct Deposit. Anyone may use this form and it is meant to simply provide a place for this information to be gathered then submitted to the proper entity.

- Wells Fargo includes a routing number on its deposit slips, but THIS MAY NOT BE THE CORRECT ONE FOR YOUR ACCOUNT. Use the methods above to validate you enter the correct routing number. This is a sample deposit slip for Wells Fargo. DO NOT USE this routing number.

Enter your username and password to securely view and manage your Wells Fargo accounts online. Beginning of popup Notice. For your security, we do not recommend using this feature on a shared device. Save Username Checking.

Credit Card Promotions

- Wells Fargo Cash Wise offers a $150 cash rewards bonus after you spend $500 within the first 3 months. This card earns 1.5% cash rewards on purchases. There is a 0% intro APR for 15 months on purchases and balance transfers. After that, a 14.49% - 24.99% variable APR. Balance transfer fees apply. There is a $0 annual fee.

- Wells Fargo Platinum offers 0% intro APR for 18 months on purchases and balance transfers. After that, a 16.49%-24.49% variable APR. Balance transfer fees apply. There is a $0 annual fee.

Checking Accounts

Wells Fargo frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select cities, so make sure you read the fine print carefully.

Wells Fargo checking accounts offer free mobile banking, account alerts, and free online bill pay. Accessing your money is convenient with free access to over 13,000 ATMs nationwide.

Everyday Checking Account Features

This is Wells Fargo's most popular checking account. It requires a minimum deposit of $25. Here are some unique features:

- Optional Overdraft Protections. Wells Fargo offers a few protection options in cases of accidental over-withdrawal. Overdraft Rewind erases the overdraft if you receive a direct deposit that covers the amount by the next day. You can also link a savings and/or credit account and funds from that account will be used to cover overdrafts. Or when your balance isn't enough, you can choose to go through with the transaction only if you approve it.

- Card-free ATM access. If you need to withdraw money, but forgot your card at home, you can access Wells Fargo ATMs with a code instead. From your Wells Fargo mobile app, you can request a one-time code. Then you'll be able to complete any available ATM transactions. This feature is free.

- Pause lost debit card. If you misplaced your debit card, you can temporarily turn it off so others can't use it. Once you've found it, just simply turn it back on.

- Custom debit card. You can design your debit card to reflect your personal style. You can choose your own photo or one from Well Fargo's image library for your debit card.

There is a $10 monthly service fee, but it can be waived by doing just ONE of the following:

Wells Fargo Deposit Check Online

- Make at least 10 posted purchases/payments each month on your debit card

- Have at least $500 each month in qualified direct deposits

- Maintain a $1,500 minimum daily balance

- Link a Wells Fargo Campus ATM or Campus Debit Card